And what they must do to succeed in the new economy

Please reads Parts I, II and III prior to reading Part IV.

What we have been discussing in Parts I through III, is in fact the effect of business environmental changes on the typical small to medium (STM) during the ‘Great Recession.’ The changes to STMs has been affected by economic factors outside of their control, changes in markets, customers, the competition, and even maybe the availability and use of new technologies.

What we are saying is that an STM’s organization must change to adapt to the new and different environment. We are postulating that the old approaches to operating an STM will not work as well as they did before, the evidence is at hand that most STMs are struggling to exist. And we have provided evidence that the rigidities engendered by the threats and stress of the environmental changes makes it difficult for STM managers to successfully adapt.

The approach that we are recommending is that the STM first audit itself to determine its strengths and weaknesses, and define and evaluate the assets that can be used to put it onto a new performance trajectory. And create a super-ordinate goal.

The assets STMs should evaluate, includes its, physical assets, its intellectual property and most importantly its people – human assets. People make up an organization (and they implement its strategies), and they account for between 26% and 75% of the total cost of operating a business (about 50% average). A significant amount of money for any business.

Organizational Effectiveness

Given that an STM’s people are a huge part of the cost of its operations (cost varies with the type of business) it would behoove an STM to find out how effective its organization is. There are numerous techniques for estimating the effectiveness of an organization. Techniques like Malcolm Baldrige, the Balanced Scorecard, or even TQM and Six-Sigma approaches.

Most of these techniques are costly and take significant amounts of time to apply. They are also ‘proxies’ for the measurement of effectiveness. A simple and low cost method (which has wide application) is what is known as the “Employee Engagement Survey.” This simple and inexpensive tool, can provide results (almost immediately) about an organization and can show if it either OK, or has problems. And it will provide some indication as to where problems lie.

Douglas Conant, CEO of Campbell Soup Co, comments on applying Engagement Surveys “Besides our improved financial and market performance, the biggest benefit has been the revitalization of our whole culture. We’re performing at a higher level, we’ve become more innovative and we’ve become more self-governing. That all contributes to our being on track to have one of our best years ever, despite the worst economy of our lifetimes.”

There are numerous companies who provide Employee Engagement tools that are applied either on-line or by pencil and paper. A typical STM can survey its organization for circa $500.

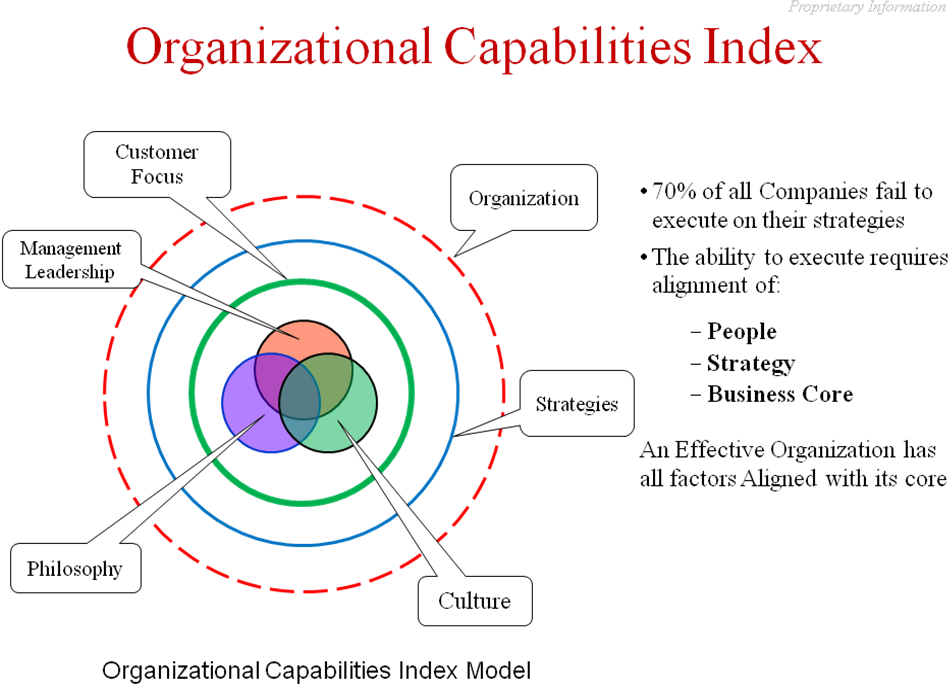

Illustration 2

An STM will discover how it measures up against other like organizations, its industry and nationally. Internal problems such as with management will also be highlighted.

After applying this method of self-discovery, an STM should look for help in setting up management development processes. And employee job-fit evaluation tools to help their organization become more effective.

Illustration 2 above indicates that most companies do rather poorly at executing on their strategies. The main reason being that their leaders have either been unable to, or unwilling to, establish a correlation between their company’s operations and its goals. And to understand the realities of how its target markets are actually performing, or how its customers’ needs can change rapidly. Good execution requires leaders to manage three interrelated and interdependent business components: People, Strategy and the Business Core.

The Organizational Capabilities Index (Illustration 2) provides a convenient picture of the relationship and the alignment of the key factors necessary for an effective organization. It is, in essence, a map of the organization showing the factors that are essential for an effective organization and showing their alignment.

The broken red circle is the boundary of the organization, outside of which is its business environment. The environment includes the economy, industries, markets, customers, competition, technology, etc. The interface to the environment is the organizations strategy; this is what it implements in reaction to what exists there. Since the environment is dynamic the organization is must be adaptive and nimble (contrary to what we have learned about STMs).

And the thing that drives (and implements) the strategies are its people who are underpinned by the strategic core of the organization.

The Strategic Core

There are numerous sources of help and information about discovering, developing, and declaring the elements (factors) forming the core of any business (Values, Culture, Leadership). If an STM’s management has not examined these fundamental factors and articulated what they mean for their company, then there is probably good reason that their company is struggling.

Articulation of the core factors should spell out what makes a company tick and how it ticks. There are reasons for a company’s existence – their “Reason for Being,” their vision, and on and on. This paper is not the venue where this topic will be pursued. But nevertheless the examination and articulation of a business’ core is extremely important, especially for an STM that is trying to steer a course out of this major economic downturn.

An STM’s CEO should be able to articulate his ‘company’s culture’ at the drop of a hat.

What is also important for an STM is its human assets – its people. We will discuss strategies later; but who implements them – people do. But most STM managers approach managing their people with the same brand of ‘common sense’ that they use in the conduction of the rest of their business. Yes, most STM managers know a lot about their business, their products and maybe their customers but they in general don’t know a lot about their people.

Human Assets, the Workforce

“If employees are a company’s most important asset, few organizations are anywhere near realizing their full potential,” according to a talent management study by the Institute for Corporate Productivity (i4cp). Only a quarter (25%) of the companies surveyed had a talent management evaluation and development processes in place.

Talent management refers to the process of developing and retaining current workers, developing and integrating new workers, and attracting and developing the highest skilled workers possible to work for the company. High performance companies are strategic and deliberate in how they source, attract, select, train, develop, promote, and move employees through their organization.

Peter Drucker’s famous statement “What you can’t measure, you can’t manage” is so true for most STMs. The lack of real and meaningful performance metrics in STMs is epidemic. Especially true when they are among the lower performing organizations.

High performance companies are ‘performance driven’ meaning that management has developed a metrics system that correlates with the company’s culture. And its workforce focuses its efforts (to its greatest extent) on achieving the organization’s goals. Performance driven metrics are of paramount importance in the 21st century, as US businesses become more knowledge based.

Performance Metrics

High-performance organizations – companies that have outperformed their competitors – are much more focused on talent management metrics. Top organizations were more than twice as likely to emphasize the measurement of talent management (37%) versus (16%) by low-performing organizations (i4cp). The metrics for business performance are:

- Revenue Growth and Revenue per Employee

- Market Share – Innovation

- Profitability – Earnings and Earnings per Employee

- Customer Satisfaction

Other research has shown that this whole area of acquiring and utilizing human resources is ‘just too much like rocket science’ for most STMs. Utilizing metrics to assess the quality of the talent that is currently in their workforce, is a very ‘foreign concept.’ And thus we get back to “their kind of common sense,” and trying to “repeat what they did before, again and again”

The performance metrics used to evaluate employees should highlight how an employee contributes to the business metrics (above), as well as to measuring their engagement level, and understanding of, and actual alignment with, the company’s strategy and objectives.

- Start by auditing current workforce metrics. Are they structured and logical, or are they just gut feel (be honest)? Are they consistent (for every job) and validate-able (measure what they should measure)? Do they correlate with the four performance parameters shown above?

- The metrication system must promote higher performance. The organization should have specific goals and processes outlined for each department, or team. Management should assure goal congruence, including employee objectives and activity level metrics.

- Establish a system incrementally, not instantaneously. Make managers part of the process, so they understand its purpose (and can communicate it), and buy into it. A company should not want to invest in a system that no one believes in, or will act on.

- Make the system Win-Win. Employees need to know why they are being measured, and what is in it for them, at the end of the day. Success for the company, should also mean success for them, everything about the metrics system must be transparent and consistent.

It is recommended that companies who do not have existing metric systems (or gut-feel based systems) develop a whole new set of performance based metrics. Metrics that are suitable for the type of business they are in.

These companies should start with just one or two metrics for each group or team in their company. These one or two metrics should be support a congruent set of goals, established by management. The metrics must be easily measured; that is a litmus test for choosing any metric.

There are numbers of metric systems that could be adopted, like the “Balanced Score Card” (Robert Kaplan, David Norton (Harvard), there are even software packages available. However the objective of this paper is to outline approaches to STM managers that are low cost, low risk with low intrusion-ability. Not having a great impact on the day-to-day operation of a business.

Using ‘What We Got’

There is an overall assumption being made in this paper; it is that the STM who has survived the recession, is seeing an up-tick in business, and is desirous of improving its future position and performance. We are also assuming that the STM is not in the position of being able to acquire, new assets (human or otherwise) but will have to use what it already has.

It is clear that the most important area where an STM can begin to make a change is in better utilization of its human assets, especially since they are 50% of the organization’s ‘cost of doing business’. We are also assuming that STMs do not possess a state of the art HR department. Most STMs have limited HR resources (more like personnel departments) or none at all.

What we will outline in this paper will be approaches and tools that STM managers can use, maybe after having co-opted some help, if they think they need it. We have already introduced some suggested methods for improving human resource utilization, i.e. a metrics systems and measuring the level of employee engagement.

Now, as organizations begin to think about recovery, workforce planning emerges as a key strategy to help them identify and address labor imbalances and develop the talent required to grow their operations. What is workforce planning? While STMs may have a basic manpower process in place to ensure that there are sufficient people to support their current strategy, it is hardly a workforce strategy.

Will it identify critical skill gaps and does it outline how the organization is going to compete for long-term success? Probably not! STMs must display rigor in translating strategic plans to human capital plans if they are to retain or develop the necessary talent required to achieve business success.

Human Capital Implications

In order to develop a strategic workforce, STMs must know how to interpret the human capital implications of a business strategy, however the stark reality is, few STM managers are capable of doing this. In order to develop a people plan to support future business objectives, companies need to make critical decisions around what they really want from their workforce.

STM managers need to ask themselves these five questions:

- Do we have the right number of the right people to make our business strategy work, and have we developed a process to determine who the right people are?

- Are we developing (especially managers), deploying, and rewarding employees properly?

- Do we have the decision-making, managerial talent and structures, work processes and information systems that will make the workforce effective?

- Are we doing what is needed to motivate and retain key people, especially during this critical transition period of environmental stress?

- Do we have a solid plan for integrating people and human capital programs into a combined operation (or, for certain transactions, moving people and programs into separate entities)?

Answering any of these questions negatively, indicates for managers, where they need to focus, and where they need to develop (or acquire) processes and tools.

A detailed analysis should be made to identify gaps between the current workforce and the desired future workforce, so that management can put a plan in place to close the gaps.

This analysis goes far beyond traditional methods, e.g. benchmarking and best practices. This needs a sophisticated, facts-based analysis that looks at the workforce’s record and overall business performance. Managers can use the data contained in employee records (financial and other), and records in the operational systems of the company.

Predicting Performance

Managers should determine the workforce practices and programs that support business performance, and those that are hindering it. They should also perform hard-skills/soft-skills evaluations of each employee. They can use existing employee performance records, resumes, etc to determine hard skills and psychometric tools to determine soft skills and preferences.

There are numbers of psychometric tools available that run on the web, they can provide insightful data that will allow managers to predict future performance and get the best “job-fit” (essential for the highest performance). The tools used should have validation records of the highest order. Tools like Myer Briggs are not useful for the purpose of predicting performance.

The broad class of tools that should be used are known as “normative” tools, these tools measure various characteristics of an employee against a large and random population. Myers Briggs is what is known as an ‘ipsative” tool in that it measures the characteristics of a candidate against the candidate. To a great extent, it expresses the candidate’s behavioral preferences.

Some normative assessment tools can be used to measure ‘job fit’ by creating standard profiles of cognition and behavior for each particular job. Profiles are usually developed by evaluating workers who are considered to be performing at a high level, and using their assessment results to statistically develop a standard profile. Job candidates are then assessed, and their results matched against the standard profile. This process is reported to have a high degree of success.

See these sources for further information of the points discussed in Parts I – IV of this post.

- How Employee Engagement Turned Around Campbell’s – T. Waghorn, Forbes Magazine 6.23.2009

- Management: Theory and Practice – C. Lorenzana MA;

- Measuring Organizational Effectiveness, J. J Jamrog, Dr. Miles Overholt; Human Resource Institute

- Profiles International – America’s Most Productive Companies 2009 – Dario Priolo; www.americasmostproductive.com

- The Balanced Scorecard – Measures that Drive Performance, Harvard Business Review, Feb. 1992

- Threat Rigidity Effects in Organizational Behavior: – Administrative Science Quarterly, Vol. 26, # 4 Barry M. Staw; Lance E. Sandelands; Jane E. Dutton

Copyright 2008 – 2010 Henry Gregor, StrategicVisions. All Rights Reserved Worldwide.

Hi Ronald,

I assume you are looking for the location of parts I – III. If you look at the top of Part IV, there are links to all 3 parts. Part V will be released as soon as possible. Thanks for reading the articles – I am glad you found them of value.

Best regards,

Gina

Hello Sameer,

I am responding on behalf of Henry. He is unreachable currently and asked me to respond on his behalf. I am glad – and so is he! – that you found his articles of value. Part V is en route! Henry has some outstanding experience in this area and I’m pleased that he has been willing to share that knowledge with my readers.

Thanks again!

Best,

Gina

Henry

I have read the articles on your blog. They’re very useful for all types of business , if the stakeholders not getting panic they would perform and can help to enhance the staff capabilities.

Thanks.

regards,

Sameer

Hello,

I have read some articles on your blog. They’re very productive and can help to enhance ones capabilities. Thanks for the innovation.

Please help me get the four parts of ‘Why companies underperform’

Thanks.

regards,

Ronald