And what they must do to succeed in the new economy

In Part I we outlined why companies underperform in the long term, let’s now take a look at why they underperform in the short term, and what they can do about it.

Most companies can do pretty well when they are immersed in an ebullient economic environment; their sub-optimizing characteristics get hidden by the plurality of financial results. And the fact that they are sub-optimizing goes unnoticed by the company’s management, shareholders, and by its Board of Directors (in most cases.)

Corporate Sales Planning

Most companies run their businesses using an incremental budgeting process, whereby the company’s upper management creates a sales plan (usually in the last month of the current fiscal year) for the upcoming fiscal year. Management usually uses a number of forecasting techniques such as “Top-Down,” “Bottom-up,” plus statistical and maybe econometric methods (and gut feel too) to forecast and decide on (judge) their sales for the coming year.

The CFO will then use his team, and maybe divisional management, to create a pro-forma income statement and balance sheet for that upcoming fiscal year. Sounds pretty clinical! However many companies start on the right planning track, and then get it mixed up by the need to meet other objectives, or investor expectations, or to satisfy the ‘greed for growth.’

The end result is a set of numbers that are handed down to division management, from which they must run their individual businesses. The division’s managers will then work on the projects to be implemented, the investments to be made, promotional activities and the division head-count, etc. The division’s budget is usually an incremental change to its previous budget reflecting the changes in the overall company sales expectations.

Wham-Bam-Boom

And then along comes the dramatic and disastrous downturn in the US (and the world) economy, beginning in 2009, resulting in what is now being called “the Great Recession.” This so called great recession could cause significant structural changes in the US’s economy, for the long term.

If indeed structural changes take place, US corporations will be required to re-think how they operate, and how they will operate into the future. The current national economic forecasts are showing a rather slow growth and a flattening of the US GDP to about 3% per annum, out through the rest of this decade (beginning 2010).

It is therefore unlikely that US companies will get themselves out of their current situations riding the growth in GDP; they will need to take a different approach to doing things.

One of the serious problems companies encountered as a result of this dramatic economic environment was a step change in orders and cancellations. At the same time corporate valuations tanked! The US economy had just gone over a cliff and everyone (companies) had to react immediately to ensure their economic and operational survival.

As a result corporate budgets ‘went out the window’ and most organizations went into the first of a series of employee layoffs, and expense and expenditure cuts. Unfortunately managers had to react so quickly to protect their organizations, that there was not a lot of science applied to what they had to do to ensure their further existence.

They Threw Out the Baby

In many situations ‘the baby was thrown out with the bathwater,’ metaphorically speaking. Managers and HR departments had to decide very quickly on cutting expenses (usually the headcount), and often did it by laying off the highest paid workers, irrespective of capabilities and asset value to the company. They also put all expense generating items in deep freeze.

The US economy came out of its recessionary phase mid 2009 but unemployment continued to increase to midyear 2010 where it hovers just under 10%. Some businesses, especially the large multinational and technology based businesses have seen a very distinct uptick in earnings and revenues. Companies like Intel and Ford reported record earnings for Q2 2010.

The distinct difference in ‘this’ recovery is that companies are showing much better financial performances with much reduced employee headcounts. In fact Ford registered its record earnings with less than half of its 2005 headcount, and Intel too, with about 60% of its former headcount. On top of that the ratio of US workers to foreign workers for these companies has shifted to where about 50% of their workforce was offshore.

On the other hand however, many small to medium companies whose field of business is restricted (on the most part) to the US are struggling to get to a more consistent and stable level of business, where the ‘red ink’ is much less of a concern. Unfortunately many companies in this class whose business is tied to the construction industry have either gone out of business or are very much still in the ‘business fetal position.’

It is pretty clear however that small to medium sized US based companies are struggling, whereas the multinationals are booming. These companies are booming, but they are doing it with fewer employees, and this may be the structural change we talked about earlier, productivity (how to gain it and maintain it) has now become ‘job-number-one.’

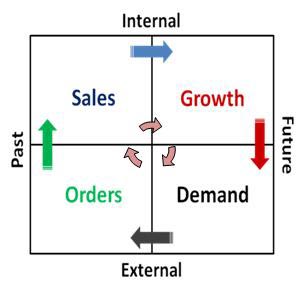

Illustration 1: Business Activity Cycle

The Boom-less

Doing more with less is now the new mantra for US industry. This is the structural change that will affect the ongoing unemployment rates, the lending and borrowing rates and the demand for skills and insights, and how corporations will operate.

It appears that the US will end up with a high level of structural unemployment. With about 17 million unemployed (or underemployed) and with about 130,000 new entrants into the workforce each month, there is no way the US can avoid a level of structural unemployment that would have been unthinkable in the past.

So the new mantra demands that to be successful all companies must do more with less, fewer people, fewer internal resources, with higher levels of productivity from all its factors. Usually of labor and capital (in a classic sense) including capital facilities such as automation, but it should include the value transferred to customers via the products and/or services a business supplies.

The question thus emerges “what should a company (that is emerging from the Great Recession) do to embody the new productivity mantra?”

Business Activities

Shown in Illustration 1, is a graphic of the typical Business Activity Cycle which applies to most for-profit companies. Demand leads to orders, orders translate to sales, and the earnings generated from sales leads to growth. A company’s sales and marketing activities lead to demand creation.

There are two factors of activity that have lead to the US’s unemployment rate; lack of ‘demand’ and (the new mantra) the desire for productivity. Another fundamental affecter that is not shown is the availability of capital, either equity capital, or loans and/or lines of credit.

As we examine how businesses effect the necessary gains in productivity, we will explore the productivity of capital (and transferrable value) in more depth.

Let’s look at the gross effects of the Great recession on the Business Activity Cycle. Instead of an expanding circle, the activity cycle becomes a shrinking spiral. Demand shrinks or goes away, causing a drop in orders, which causes a drop in sales (shipments or services provided).

Growth is a conscious internal business activity, the desire for growth shrinks causing less stimulation of demand for products and services. Stimulation usually means sales and marketing efforts. The recessionary environment causes activities to become predominantly left sided (in the chart), i.e. companies become less futuristic (right sided), using less stimulation.

Most companies will behave (as outlined in Part I) with rigidity of thought and action, as a result, and concentrating in the past, using repeated actions and strategies that have worked in the past.

Copyright 2008 – 2010 Henry Gregor, StrategicVisions. All Rights Reserved Worldwide.